Conscious Capital® works with business leaders to realign their pitch to attract aligned investors and partners; model their company’s financial plan; optimize their company’s brand and market position; and, then introduces them to family offices, institutional investors, clinics, centers of innovation, and governments that may help them to execute their growth strategy.

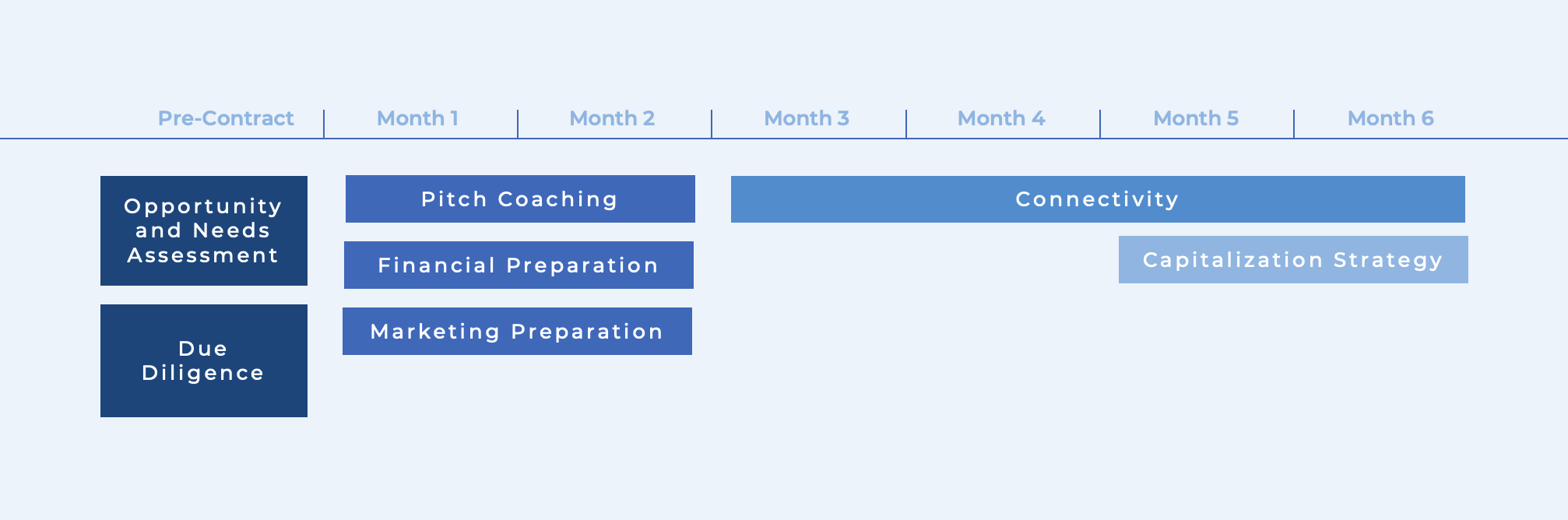

Assessment

Opportunity Assessment

- Initial executive meetings

- Market analysis

- Preliminary due diligence

- Review current investor engagement strategy

- Determine fit with investment community

Needs Assessment

- Collection and review of all corporate documents and marketing materials

- Review current investor engagement; pitfalls and successes

- Review of financials and strategy for long-term growth and maximum impact creation

Pitch Coaching

- Realign your pitch to what your audience really wants to know

- Get inside the family office and institutional investor mindset

- Develop your value proposition / narrative

- Gain feedback on content and delivery, including mental preparation, voice tone, and body language

- Overcome cultural NOs that get in the way

- What not to say: the five mistakes to avoid

- What to say: the 10 key points to cover in every pitch

Financial Preparation

- Financial due diligence

- Creation of an independent valuation

- Margin and growth analysis

- Analysis of use of funds

- Creation of a financial model

Marketing Preparation

- Brand development

- Company story consistency

- Creation of executive summary

- Creation of new investor presentation

- Website review for consistency

Connectivity

- Virtual meetings

- In-person meetings

- Incorporate investor feedback

- Review of due diligence requests and responses

- Coordination of on-site visits

Disclaimer: Conscious Capital AG, Conscious Capital, Inc., and Conscious Giving, Inc. (collectively referred to hereinafter as “Conscious Capital”) are legally independent entities. Conscious Capital and its affiliates, and their respective employees, officers and directors take no part in the negotiation or execution of transactions for the purchase or sale of securities. This website is not to be used or considered as, does not constitute or form part of, an offer to or solicitation of an offer to sell, purchase, exchange or transfer any securities or invitation to subscribe for any securities in any jurisdiction, and does not constitute an advertisement of securities in any other jurisdiction. Use of this website is not for any person or entity that is a citizen or resident or located in any locality, state, country, or other jurisdiction in which such use would be contrary to law or regulation, or which would require any registration or licensing within such jurisdiction, including, but not limited to, the United States, Canada, Australia, the United Kingdom, or Japan. For additional disclaimers, please click here